The piercing line pattern is always overlooked in today’s markets.

It’s an interesting pattern that can predict a price reversal.

In this guide, we’ll go through how to trade a piercing line pattern and understand the theory behind it.

So if you haven’t a clue about what this pattern is, then by the end of this guide you certainly will.

Check it out:

What is a piercing line pattern?

For you to find a piercing line candlestick pattern they normally form at the end of downtrends.

These piercing patterns are a two-candlestick pattern and are a reversal pattern, with quite an accurate rate too.

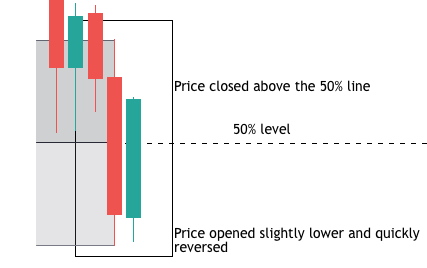

The key behind this candlestick pattern is that the second part of the pattern “pierces” at least 50% of the previous candlestick’s body.

The name is given because the signal candlestick pierces at least 50% of the previous day’s candlestick.

This means that it closes above the 50% level.

A special part of this piercing pattern is that normally the piercing candlestick gaps down first, which is common in the stock market, but uncommon in forex due to the higher liquidity and longer opening hours.

Just like all candlestick patterns that form gaps, they work with forex too.

However, they do still occur and in forex particular – the gap down is not needed to provide a valid piercing line candlestick pattern.

Instead, to combat this difference, you would like to see that there is a lower wick that formed immediately after the opening.

This gives a sense of the price action moving down like you’d expect a gap to occur.

Let’s take a quick look at the pattern:

The theory behind a piercing pattern is that the short sellers have been quickly and aggressively halted and reversed by an influx of buyers.

The buyer pressure is so much, they’ve essentially absorbed the sellers from moving any lower and pushed the price back up above 50% of the previous trading sessions candlestick.

This shows intent from the buyers to continue pushing higher.

Thus, with this intention, this should give a trader the ability to understand the shift in trading bias and take advantage of it.

How accurate is it?

Most candlesticks can produce strong signals of a reversal or a price continuation.

According to Tom Bulkhowski, based on his tests he found that the piercing line candlestick pattern achieved an average of 64% accuracy.

This kind of figure certainly gives you an edge in the marketplace, but you should not expect it to work consistently at this accuracy.

There are plenty of factors that take place you should consider when entering any trade.

Naturally, always do your own research.

What is the best time frame to use it on?

The time frame is down to personal preference for each trader.

It depends on how frequently you want to trade and how much capital you have.

It would be best to run your trades on several time frames if you are a beginner and then figure out where you performed best.

One tip is to do it based on % success and not pips gained.

Because larger time frames = larger pip gains but you may trade once a week.

Whereas smaller time frames = smaller pip gains but you may trade once a day.

How to identify a piercing line pattern

There are two key factors that help identify the piercing line pattern, these are:

The bullish candlestick closing above 50% of the previous candlestick

The market opened and initially traded lower almost immediately.

This short push lower, then trading higher in the same session gives validity to the buyers entering the market.

Let’s go over an example below:

You can quickly identify the 50% mark by using the Fibonacci retracement tool or the Gann box, both of which can be found on TradingView.

You can see in the piercing line pattern example above I’ve used the Gann box tool to quickly measure it.

How to trade a piercing line pattern?

Now you know the theory, let’s go through how to trade a piercing line pattern.

If you’ve followed any of our other candlestick pattern guides you’d probably be able to guess how we’d do this.

We take a variation of the engulfing pattern entry-level but tweak it slightly.

When you discover one of these piercing patterns, they are easy to trade, but for me personally, I like to see more price action to encourage the move higher.

This is a slightly lower risk version of how to trade them, but the lower risk is the premium we pay for a strong confirmation.

1. Identify the bearish trend

As we now know that piercing line candlestick patterns form at the bottom of a downtrend.

2. Identify the piercing line candlestick pattern

With the downtrend confirmed you will have to wait for a piercing pattern to form.

There are no guarantees that they will form, but you’ll be able to notice them rather quickly when they appear.

3. Set the stop loss

Once the piercing line pattern has formed and the signal is validated you want to set your stop loss 1 or 2 pips below the lower wick of the previous candlestick as you can see below:

4. Execute the trade

You want to place your entry 1 or 2 pips higher above the previous session’s candlestick pattern’s high.

This gives a confirmation that the markets are looking to go higher.

This is a higher entry point than we’d normally do, but as stated before, the premium to avoid a shakeout is worth it.

If you want an earlier entry-level then place your buy order at the piercing line candlestick’s high price.

Then we wait for the market to hit our buy order.

5. Take profit

Your take profit should be set at the nearest market structure or resistance level.

These are easy to obtain take profit levels and have a high degree of the market to trade towards the nearest resistance level.

That is it.

The outcome:

As you can see with the trade it continued to go higher from the buying pressure signalled by the piercing line candlestick pattern.

Piercing pattern vs bullish engulfing

Both of these candlestick patterns indicate the same thing, but some traders neglect the difference between them.

The bullish engulfing pattern consumes the previous candlestick, which is a clear signal that buyers are in control.

Whereas the piercing pattern pushes the lower price past 50% of the previous trading sessions candlestick, and therefore, shows intention behind a possible change in trading direction.

Personally, the bullish engulfing pattern has more strength behind it and therefore plays out more often.

Conclusion: Piercing line Pattern, should you trade it?

To summarize: The answer is yes. As long as you keep in mind all the above points before entering the market, you’re on your way to being a successful trader.

You should trade it when you see fit.

It shouldn’t be your only trading strategy, because there are plenty of patterns that form at the same time that show just as many encouraging results.

If you have any questions or found value in this piercing line pattern guide, please feel free to share on social media & reach out to us.