Another well-used method for risk management is understanding how to scale a trade in and out. This takes forex trading for beginners to another level. We call this pyramiding too and this is the reason…

As you can see that the base of the pyramid is the largest initial position followed two more opportunities to scale in.

The advantage of applying this method is that you instantly reduce the risk by testing the market direction with an initial 50% position size.

If you get the wrong timing of the execution, or the trading idea isn’t valid – you will learn just as much with 50% as you would with 100% trade size.

How To Scale Trades: The Tactics

This is a common tactic used by longer-term investors.

This method is also applied to forex trading but on a more rapid timeframe.

The 25% position deployments are usually when either the market pulls back, penetrates near-term support and resistance level, or any other confirmation indicator gives the go-ahead, giving us a better price and confidence that the trading idea is validated.

Once you are fully scaled into a position, you are also at 100% risk. However, by this point, the market has validated your ideas 3 times – which is very encouraging.

With full position deployed – it is time to talk about scaling in more capital.

Now that you are in a validated trade, thanks to Mr. Market, you can scale your position greatly using the same metrics as pyramiding your trades in.

This is how you can truly capture a trend and consistently profit from it and makes one good short-term idea into a hugely profitable long-term trade.

By applying the 50/25/25 rule you’ll be waiting for 3 areas the market validates your trade. Meaning you can scale in quite quickly. However, you can adjust this to as you feel comfortable. You could even use a rectangle for riskier trades – 25/25/25/25.

Let’s take an example:

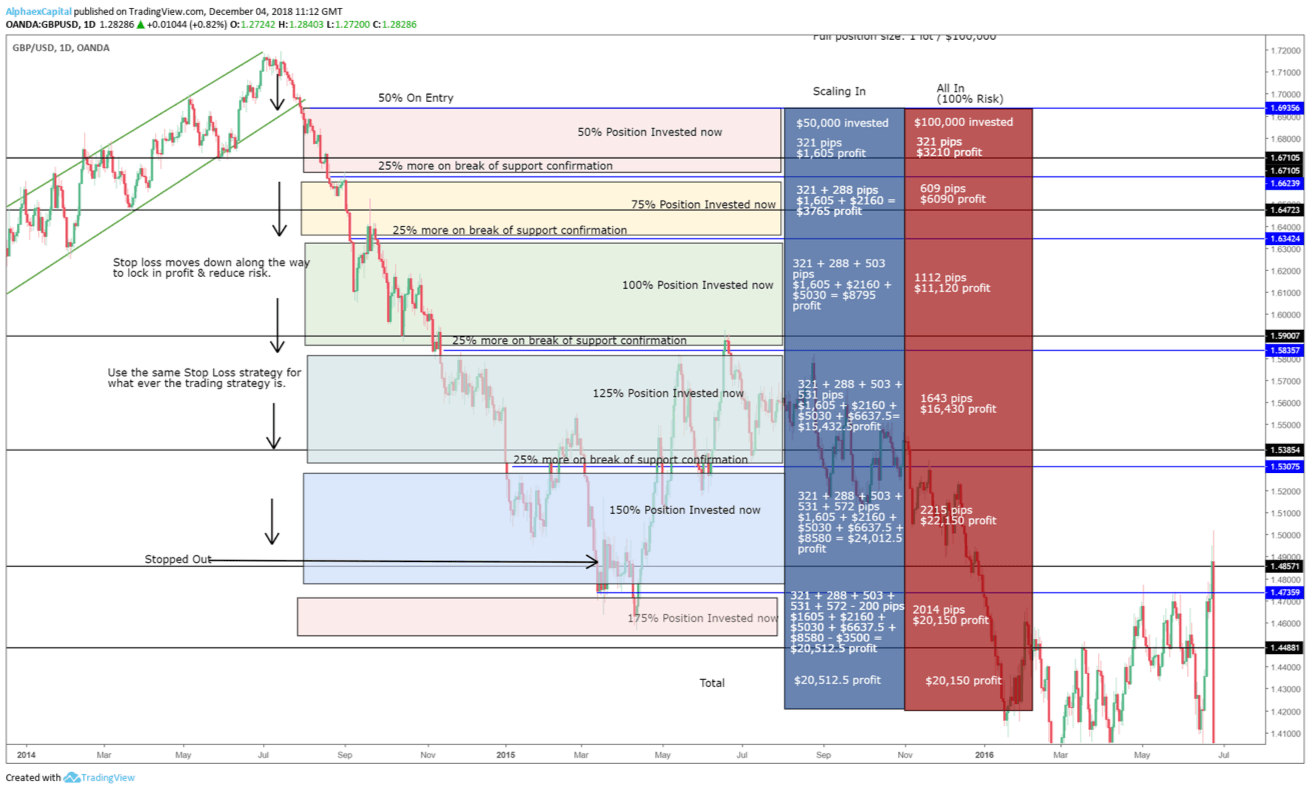

As you can see in this example by using breakouts from the support we were able to scale all the way down to 175%.

Although at 175% scaled into the trade, this was the absolute bottom and we got stopped out.

Let’s take a look at how it compared between scaling into a trade and opening a full position from the start.

As you can see from the results by pyramiding and scaling into a trade we captured an extra $362.5 profit whilst risking the same.

Scaling into trades is best when you are in a trade for a longer time period as this builds your position over time, whilst reducing whole market risk.

Scaling out of a trade is the same principle, however, instead of adding and building on to your position, you take away your underlying investment and let your profits run a while longer.

The aim is to scale out and lock in profit over time.

So if you were at 100% invested risk, you can lock in your profit by either:

- A) Moving your stop loss higher

- B) Partially selling your position to reduce the amount invested.

A is used more frequently than B due to its simplicity plus it will keep the pip value the same going forward.

B is used to move the capital from one position to invest in another, it frees up traded capital.

Both have the same end result.

Scaling trades may not be for everyone.

If you are scalping, for example, your mindset and profit targets are different to those who are looking for large profitable trades vs. more frequent tiny profits.

However, nothing can stop a scalp from being turned into a larger trade and by knowing how to scale trades, you’ll be able to adapt to your environment and extract more value from your correct trading ideas.